B2B SaaS Growth: Strategies, Stages, And Playbooks For Scaling

October 6, 2025 • 12 min read

Growing a B2B SaaS company is not just about adding more customers. It is about balancing acquisition, retention, and monetization in a way that matches your stage of maturity. Unlike B2C, B2B SaaS businesses deal with longer sales cycles, multiple decision-makers, and the constant pressure of proving ROI to buyers.

This article breaks down the stages of B2B SaaS growth, the levers that drive sustainable scaling, and the mistakes to avoid. Along the way, you will find benchmarks, frameworks, and examples that go beyond generic advice.

Key takeaways:

- B2B SaaS growth requires different strategies at each stage, from finding product-market fit to category leadership.

- Retention and expansion are as important as acquisition in building long-term revenue.

- The right pricing model can accelerate growth or stall it if misaligned with the market.

- Common metrics such as CAC, LTV, NRR, and payback periods are essential for tracking health and efficiency.

- A fractional CPO can align product strategy with growth goals without the cost of a full-time executive.

Understanding the B2B SaaS growth landscape

B2B SaaS companies face challenges that B2C businesses rarely encounter. Decision-making involves several stakeholders, budgets are scrutinized, and the path from lead to closed deal can stretch over months. At the same time, the upside is significant because customers often sign multi-year contracts and bring predictable recurring revenue.

Key differences between B2B and B2C SaaS growth:

- B2B relies heavily on trust and thought leadership, while B2C focuses on volume and virality.

- B2B growth depends on strong onboarding and retention, while B2C churn is often higher and more acceptable.

- B2B SaaS companies can grow with fewer customers but higher contract values.

Table comparing B2B vs B2C SaaS growth challenges

| Aspect | B2B SaaS | B2C SaaS |

| Target audience | Businesses with multiple decision-makers and long buying cycles | Individual users with quick purchase decisions |

| Sales process | Complex, relationship-driven, often involving demos and negotiations | Transactional, focused on quick conversions and virality |

| Customer acquisition | Relies on content marketing, outbound sales, and account-based marketing | Driven by ads, app stores, and mass marketing |

| Onboarding | Personalized onboarding and training required for adoption | Self-service onboarding with automated flows |

| Retention focus | High emphasis on retention and long-term customer success | Higher churn tolerated, offset by large user volume |

| Pricing models | Tiered, per-seat, or usage-based contracts | Freemium or low-cost subscription models |

| Revenue structure | Fewer customers, higher contract values, predictable recurring revenue | Large customer base, lower individual revenue |

| Growth drivers | Trust, reputation, and measurable ROI | Brand appeal, convenience, and user experience |

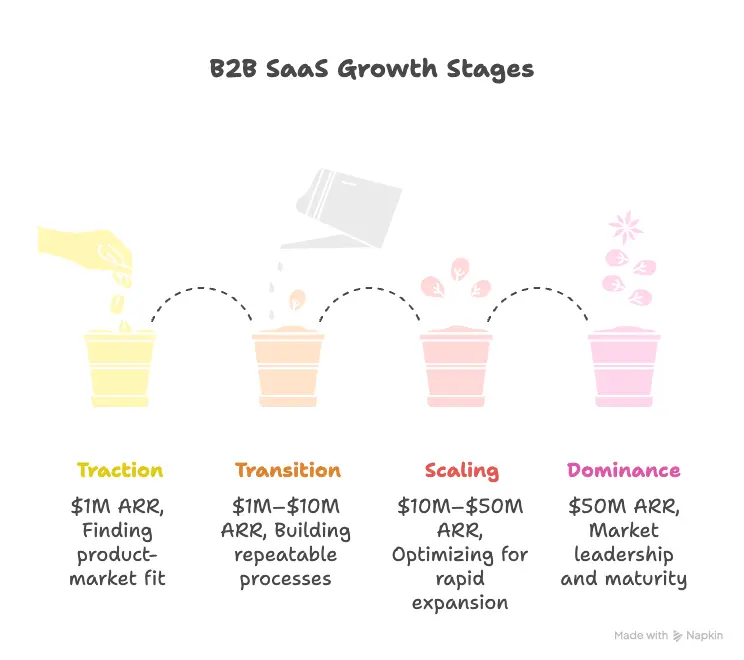

Key stages of B2B SaaS growth

Growth is not linear. Every B2B SaaS company moves through stages that require different priorities, teams, and playbooks:

Traction stage (< $1M ARR)

This is where most founders spend their energy validating whether the product solves a real problem. At this stage, the goal is not to scale but to learn. Conversations with customers are critical to refine positioning and to uncover which features deliver the most value. Early retention, customer feedback, and securing your first paying customers are more important than hitting aggressive revenue numbers.

Stop guessing. Start calculating.

Access our suite of calculators designed to help SaaS companies make data-driven decisions.

Free tool. No signup required.

- Focus: validating product-market fit.

- Actions: talk to customers, refine positioning, and prioritize core features.

- Metrics: customer retention, early NPS, first paying customers.

Transition stage ($1M–$10M ARR)

Once product-market fit has been established, the next challenge is to build a repeatable sales and marketing process. This stage is about turning founder-led growth into team-driven growth. Companies begin hiring their first sales reps, defining ideal customer profiles (ICPs), and experimenting with pricing models to find the sweet spot. Efficiency starts to matter, and leaders track how quickly they recover CAC and how well leads move through the funnel.

- Focus: building repeatable sales and marketing processes.

- Actions: hire first sales reps, define ICPs, experiment with pricing.

- Metrics: CAC payback, conversion rates across funnel.

Scaling stage ($10M–$50M ARR)

At this stage, SaaS businesses already have traction and repeatability, so the focus shifts to scaling efficiently. Expansion into new geographies, investing in automation, and strengthening customer success functions become key priorities. Companies that scale well build processes that support growth without ballooning costs. Metrics such as net revenue retention, churn, and average revenue per account start to dictate whether the business is ready for the next level.

- Focus: efficiency and expansion.

- Actions: expand into new geographies, formalize customer success, invest in automation.

- Metrics: NRR, churn rate, revenue per account.

Dominance stage (> $50M ARR)

Reaching this stage means the company has matured into a serious player in its category. The focus now is on maintaining growth momentum and defending market position. Brand building, category creation, acquisitions, and advanced pricing strategies play an outsized role. The best companies in this stage achieve sustained growth by continually innovating while keeping NRR well above 120 percent. Market share becomes a defining metric for success, as the company aims to dominate its space.

- Focus: category leadership.

- Actions: brand building, acquisitions, and advanced pricing models.

- Metrics: market share, NRR above 120%, sustained growth rate.

Snowflake: From startup to SaaS giant

During my research for this article, I came across the unbelievable story of Snowflake. Of course, I had heard about it before, but diving deeper into the details left me deeply impressed. Snowflake’s journey is a masterclass in how a SaaS company can scale from a bold idea into a market-defining giant. Launched in 2014 with a differentiated multi-cloud architecture, the company managed to grow its ARR from just $96 million in 2018 to over $2.6 billion in 2024. What struck me most was not just the speed of growth, but how much of it came from expansion revenue, proof that their product strategy was designed for long-term stickiness and account growth. This wasn’t just about acquiring new customers; it was about building a product so valuable that customers kept expanding usage year after year. For me, Snowflake is the perfect example of how aligning product vision with scalable execution can create not just growth, but category leadership.

Growth strategies that drive B2B SaaS success

Growth in B2B SaaS is rarely about a single breakthrough tactic. Instead, it comes from layering strategies that complement each other across acquisition, retention, and monetization. The most successful companies build a playbook that adapts as they move through different growth stages, combining short-term wins with long-term scalability. What follows are the core strategies that consistently help B2B SaaS businesses move from early traction to sustainable expansion.

Customer acquisition strategies

B2B SaaS companies often start with founder-led sales, then move into either sales-led, product-led, or a hybrid model. The right choice depends on ACV (average contract value) and buyer expectations.

- Sales-led growth: effective for complex deals and enterprise buyers.

- Product-led growth (PLG): effective for SMB or mid-market where buyers want to try before committing.

- Hybrid: increasingly common, combining PLG with sales for enterprise expansion.

Customer retention and expansion

Growth does not only come from new deals. In fact, expansion revenue is often the engine that allows SaaS businesses to scale sustainably.

- Customer success should be seen as a revenue function, not just support.

- Expansion opportunities include upselling, cross-selling, and usage-based pricing.

- The ultimate goal: achieving NRR > 100% consistently.

Pricing and monetization

Pricing is one of the most powerful growth levers and often the least optimized. Too many companies adopt “set it and forget it” pricing, which leaves money on the table.

Common pricing models:

- Per user or per seat.

- Usage-based or consumption pricing.

- Tiered pricing for different segments.

- Freemium or free trial models.

The best pricing model is the one that aligns with how customers perceive value.

Table comparing SaaS pricing models

| Pricing model | Description | Best for | Pros | Cons |

| Per user (per seat) | Customers pay a set fee per active user or account | Tools used by teams or organizations (e.g. CRM, collaboration software) | Easy to understand, predictable revenue, scales with team size | Limits adoption if companies share logins or restrict seats |

| Usage-based (consumption) | Pricing depends on how much of a resource or feature the customer uses | APIs, infrastructure tools, analytics platforms | Aligns cost with value, low entry barrier for new users | Revenue may fluctuate month to month, harder forecasting |

| Tiered pricing | Multiple plans with different feature sets and limits | Most SaaS products targeting multiple customer segments | Flexible for different budgets, supports upselling | Can be confusing if too many tiers or unclear value differences |

| Freemium / free trial | Free access to basic features or limited-time premium use | Products focused on virality or PLG (product-led growth) | Drives awareness, builds trust before purchase | High conversion drop-off, may attract non-paying users |

| Enterprise custom pricing | Tailored contracts based on usage, support, and integrations | Large organizations and complex solutions | Maximizes revenue potential, offers flexibility for big clients | Long sales cycles, requires negotiation and custom management |

SaaS metrics that matter

SaaS growth cannot be managed without tracking the right metrics. Investors and executives alike look for clear signals of efficiency and scalability.

- CAC (Customer Acquisition Cost).

- LTV (Customer Lifetime Value).

- Payback period (months to recover CAC).

- Churn rate.

- NRR (Net Revenue Retention).

- Burn multiple.

Benchmarks shift depending on your stage. For example, a payback period under 12 months is strong for early-stage companies, while later-stage SaaS is expected to hit under 6 months.

From the trenches: Turning founder-led chaos into a repeatable growth engine

One of the most satisfying transformations I led was with a B2B SaaS company hovering around $800k in ARR. The founder was a brilliant visionary, but he was also the single biggest bottleneck to growth. He was still approving every feature, the roadmap was a direct reflection of his last sales call, and the engineering team was completely burnt out from constantly shifting priorities.

This “founder bottleneck” is far from unique. McKinsey research shows that over 80% of startups struggle to scale effectively, with leadership dependency being one of the most common pitfalls. At the same time, Gartner projects that by 2025, 80% of B2B sales interactions will occur in digital channels, meaning SaaS companies must build structured, scalable processes rather than rely on founder heroics. With global SaaS spend expected to exceed $300B by 2025 (Gartner), the pressure to professionalize growth engines has never been higher.

My first move wasn’t to build a new roadmap. It was to get the leadership team in a room and force a tough conversation around a single question: “Who is the exact Ideal Customer Profile (ICP) we are building for?”

Once we had that definition locked down, we implemented a simple, non-negotiable rule: every new feature request had to be justified against one criterion: “Does this directly serve our ICP and solve one of their top 3 problems?”

The results were transformative. Within six months, the roadmap went from chaotic to strategic. The sales team started selling the value of our focused solution, not promising random features. Most importantly, it freed up the founder to focus on strategy instead of day-to-day tactics. By the end of that period, we had crossed the $1.5M ARR mark. We didn’t just build features; we turned the founder’s “art” of selling into a repeatable “science” for the entire company.

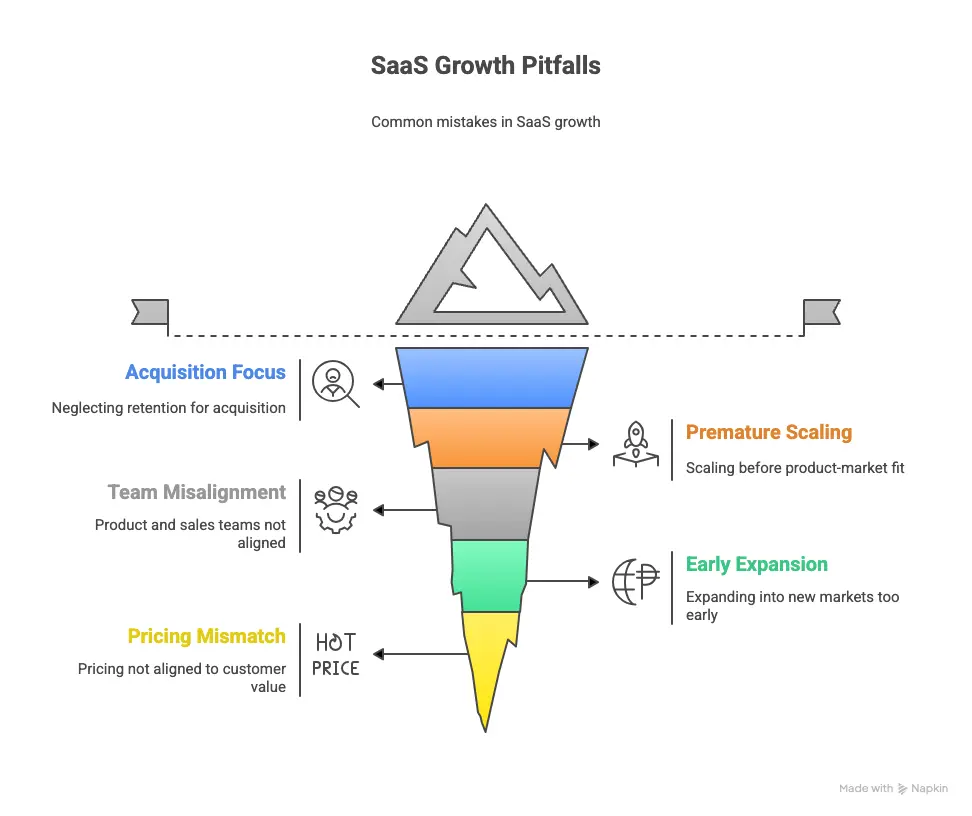

Common mistakes in B2B SaaS growth

Many SaaS companies stumble by focusing too heavily on acquisition while neglecting retention. Others attempt to scale before achieving true product-market fit. Common pitfalls include:

- Misaligned product and sales teams.

- Expanding into new markets too early.

- Failing to adapt pricing to customer value.

Future trends shaping B2B SaaS growth

The landscape continues to evolve, and companies that adapt quickly stand out. Growth strategies that worked five years ago may not be enough today, as buyers expect more personalization, faster time-to-value, and global accessibility. Several trends are reshaping how B2B SaaS companies grow, and ignoring them can put even established players at risk.

AI as a growth accelerator

Artificial intelligence is moving beyond hype and into practical application. B2B SaaS companies are already using AI to score leads more accurately, predict churn with better precision, and deliver personalized customer experiences at scale. AI-driven forecasting tools also help leadership teams make smarter decisions about resource allocation and product roadmaps. For growth teams, the ability to automate prospecting and surface the right accounts at the right time has become a competitive advantage.

Localization and compliance as growth enablers

International expansion is a natural step for scaling SaaS companies, but entering new markets brings complexity. Localization goes beyond translating your product, it includes adapting pricing, onboarding, support, and marketing to fit local expectations. At the same time, compliance with regional frameworks like GDPR, CCPA, and LGPD is non-negotiable. Companies that prioritize compliance and build localized experiences gain trust faster and reduce friction in the buying process.

The rise of usage-based and hybrid growth models

Pricing models are evolving in line with customer expectations. More buyers want to pay based on the value they get, which has fueled the rise of usage-based pricing. At the same time, many companies are adopting hybrid approaches that combine elements of product-led growth with traditional sales-led processes. This mix allows companies to serve both SMBs who want self-service and enterprises that expect a tailored buying experience. The flexibility of hybrid models is proving to be a powerful driver of sustainable growth.

How a fractional CPO accelerates B2B SaaS growth

One of the most overlooked enablers of growth is product leadership. Without strong alignment between product and revenue goals, growth stalls. A fractional CPO brings senior product expertise without the cost of a full-time executive.

- Helps prioritize roadmap features that drive revenue.

- Aligns pricing and packaging with market demand.

- Coordinates across sales, marketing, and product to ensure growth strategy execution.

Want to accelerate your SaaS growth? Work with a fractional CPO who can define the right product strategy and execution plan for your stage.

Conclusion

B2B SaaS growth is not about chasing hacks or flooding your pipeline. It is about mastering the balance between acquisition, retention, and monetization, while adapting strategies at each stage of maturity. With the right frameworks, metrics, and leadership in place, your company can move from early traction to category leadership.

FAQ’s

What is the most important factor in B2B SaaS growth?

The most important factor is achieving strong product-market fit before scaling. Without it, even the best marketing or sales efforts will fail to create sustainable growth. Once fit is established, focus shifts to customer retention, monetization, and operational efficiency.

How do you measure B2B SaaS growth effectively?

Growth should be tracked through a mix of revenue and efficiency metrics. Key indicators include Annual Recurring Revenue (ARR), Net Revenue Retention (NRR), churn rate, Customer Acquisition Cost (CAC), and payback period. Together, these show both growth pace and sustainability.

What’s the difference between product-led and sales-led growth in SaaS?

Product-led growth relies on the product itself to drive acquisition and expansion, often through free trials or freemium models. Sales-led growth depends on direct sales teams nurturing and closing deals, typically for higher-value or enterprise contracts. Many companies now combine both in a hybrid approach.

How often should SaaS pricing be reviewed or updated?

Pricing should be reviewed at least once a year or whenever major product changes occur. Market conditions, customer expectations, and competitive pricing all evolve quickly. Regular testing ensures the pricing model aligns with perceived value and business goals.

Sivan Kadosh is a veteran Chief Product Officer (CPO) and CEO with a distinguished 18-year career in the tech industry. His expertise lies in driving product strategy from vision to execution, having launched multiple industry-disrupting SaaS platforms that have generated hundreds of millions in revenue. Complementing his product leadership, Sivan’s experience as a CEO involved leading companies of up to 300 employees, navigating post-acquisition transitions, and consistently achieving key business goals. He now shares his dual expertise in product and business leadership to help SaaS companies scale effectively.