Reduce Churn in SaaS: A Complete Guide to Keep More Customers and Grow Predictably

November 27, 2025 • 12 min read

Last Updated on February 18, 2026 by Sivan Kadosh

Customer churn quietly kills growth. You feel it in slower ARR, unpredictable renewals, and constant pressure to fill the top of the funnel just to stay in the same place. Reducing churn is one of the highest leverage things a SaaS company can do, because every improvement compounds over time. When retention improves, LTV increases, CAC payback shrinks, and your entire business becomes more predictable.

This guide gives you a complete and practical approach to understanding churn, predicting it before it happens, and reducing it with strategies that work across product, customer success, and monetization. You will also see where churn benchmarks differ across SaaS models and how to build a retention strategy that fits your specific business.

Key takeaways

- Churn is not one number. It varies by model, pricing strategy, and customer segment.

- Reducing churn depends on understanding early warning signals, not just reacting to cancellations.

- Product experience, onboarding quality, customer success habits, and pricing work together to drive retention.

- Small improvements create outsized impact on LTV and growth trajectory.

- A structured retention strategy reduces pressure on acquisition and helps teams scale more predictably.

- A fractional CPO can accelerate progress by fixing product strategy gaps, onboarding issues, and misaligned pricing.

The uncomfortable truth: Is your churn actually a broken Product-Market-Fit?

Every junior Product Manager knows that churn is an outcome. But an outcome of what? The initial instinct is to look for the immediate culprits: Is it bad UI? Is the UX clunky? Is the pricing too high?

There are countless reasons users stop paying, but when I sit down with founders and product leaders, I often put one reason on the table that they do not want to hear: Perhaps your users are simply no longer willing to pay for the value your product provides.

When I present this conclusion, I see the surprise on their faces. “How did we not think of this?” They were too busy shipping features and forgot the essence. Let’s go one level deeper. If users are not willing to exchange money for the value they receive, there is a painful professional term for this problem: A broken Product-Market Fit.

As Reforge emphasizes, retention is the ultimate proof of Product-Market Fit. If the curve drops, the fit isn’t there. While it varies by product and audience, my first piece of advice in these situations aligns with the Y Combinator philosophy: Stop everything and start doing things that don’t scale, talk to your customers.

Stop guessing. Start calculating.

Access our suite of calculators designed to help SaaS companies make data-driven decisions.

Free tool. No signup required.

Do not write another line of code before you pick up the phone:

- Talk to those who left.

- Talk to those who stay and pay.

This is the only key to understanding what shifted. It is exactly the process used by the CEO of Superhuman, who built an engine for finding Product-Market Fit based on user feedback to make the product indispensable. Once you speak with a critical mass of customers, a recurring pattern suddenly emerges. And the moment that pattern is revealed: the solution to your churn problem becomes much simpler and far more focused.

However, even if the root cause is strategic, you still need to measure the symptoms accurately to track your progress. Let’s start by defining exactly what we are trying to fix.

What churn is and why it matters

Churn measures the customers or revenue you lose over a defined period. Most teams track:

- Customer churn rate

- Revenue churn rate

- Gross churn vs net churn

There are also different forms of churn. Some customers leave by choice. Others churn because of payment failures. The reasons matter, because the interventions differ.

High churn puts pressure on every part of your business. CAC rises, payback lengthens, expansion becomes less predictable, and growth slows even when acquisition improves. A healthy SaaS business grows because customers stay, use the product deeply, and eventually expand.

Churn benchmarks for different SaaS models

There is no universal good churn rate. Benchmarks depend on the type of SaaS you operate. Comparing yourself to the wrong category can lead to false assumptions.

Freemium and self serve products

These models often experience higher churn because users commit less and can switch tools quickly. Healthy companies in this category focus heavily on activation and early product adoption.

Usage based pricing models

Churn behaves differently here. Customers might stay subscribed but reduce usage, which reduces revenue without leaving entirely. Revenue churn matters more than logo churn. Benchmarks vary widely by industry.

SMB focused SaaS

Churn is usually higher in SMB markets because businesses close more often, budgets change quickly, and switching costs are lower. Accept a slightly higher baseline but compensate through strong onboarding and frequent value reinforcement.

Mid market and enterprise SaaS

Enterprise customers churn less but take longer to acquire. Renewal processes, multi stakeholder value, and contract structures play a significant role.

| SaaS Model | Typical Churn Characteristics | What Matters Most |

|---|---|---|

| Freemium and Self Serve | Higher churn because users commit less and switch tools quickly | Strong activation, early adoption, rapid value delivery |

| Usage Based Pricing | Customers may stay subscribed but reduce usage which reduces revenue | Revenue churn and usage depth instead of logo churn |

| SMB Focused SaaS | Higher natural churn due to business volatility and low switching costs | Onboarding quality and frequent reinforcement of value |

| Mid Market SaaS | Lower churn than SMB because of more stable budgets and processes | Adoption across teams, clear ROI, strong product stickiness |

| Enterprise SaaS | Lowest churn but long acquisition and structured renewal cycles | Multi stakeholder value, contract structure, strong renewal processes |

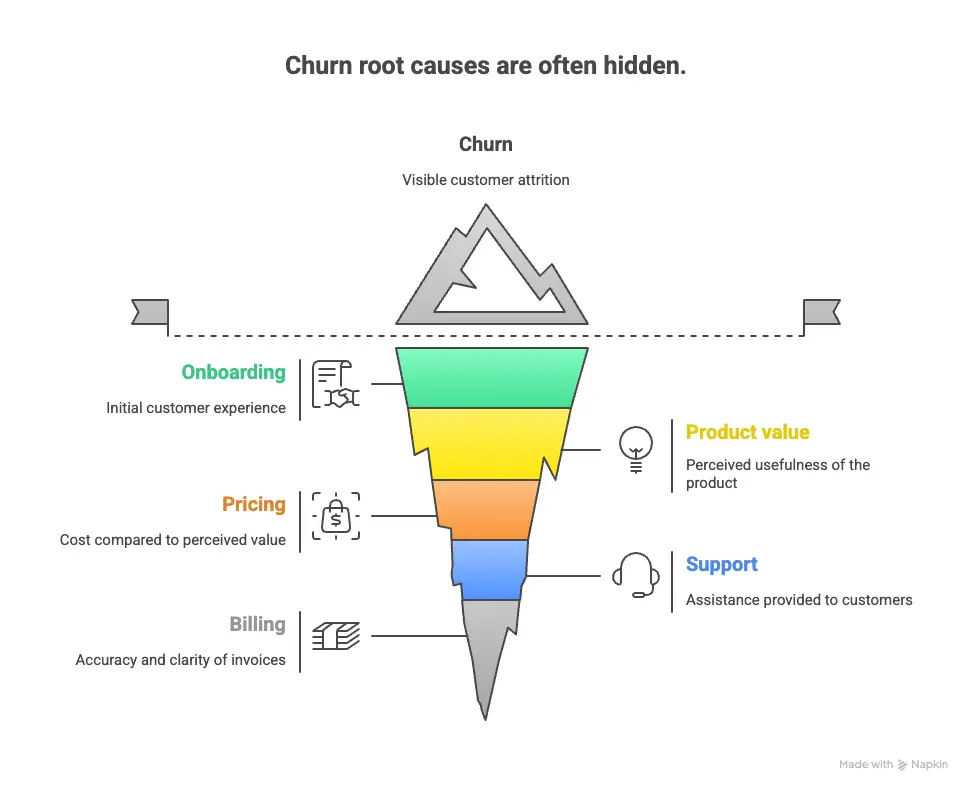

Common reasons customers churn in SaaS

Churn is rarely caused by a single reason. It usually begins much earlier in the user journey and becomes visible only when the cancellation happens. Here are the most common reasons customers churn in SaaS:

Onboarding friction and low activation

If customers do not reach their first moment of value early enough, they drift, disengage, and eventually cancel. Poor onboarding is one of the strongest predictors of early churn.

Missing or weak product value

When the core product does not deliver meaningful outcomes, users stop using it long before they cancel. Sometimes this is due to feature gaps. Sometimes the positioning attracts users who are not the right fit.

Pricing misalignment

Plans that confuse users, feel too expensive, or fail to match the value delivered often cause preventable churn. Pricing and packaging can create friction in both upgrades and renewals.

Inconsistent customer success motion

Reactive support, long response times, and a lack of proactive outreach leave customers feeling unnoticed. Most at risk customers show signs long before they churn.

Billing failures

Involuntary churn often accounts for a surprisingly high percentage of lost customers. Expired cards, insufficient funds, and weak retry logic create silent revenue losses.

Early warning signals that predict churn

High performing SaaS teams do not wait for cancellations. They monitor behaviours and signals that reliably predict churn and act early.

Behavioural warning signs

- Drop in weekly or monthly active use

- Decline in usage of key features

- Fewer team members logging in

- Reduced time spent in the product

- Abandoned onboarding flows

Support and sentiment signals

- Spike in support tickets

- Increased complaint patterns

- Low or falling NPS

- Quiet customers who stop engaging

Financial and renewal signals

- Reduced seat usage

- Requests for discounts

- Downgrade attempts

- Slower invoice payments

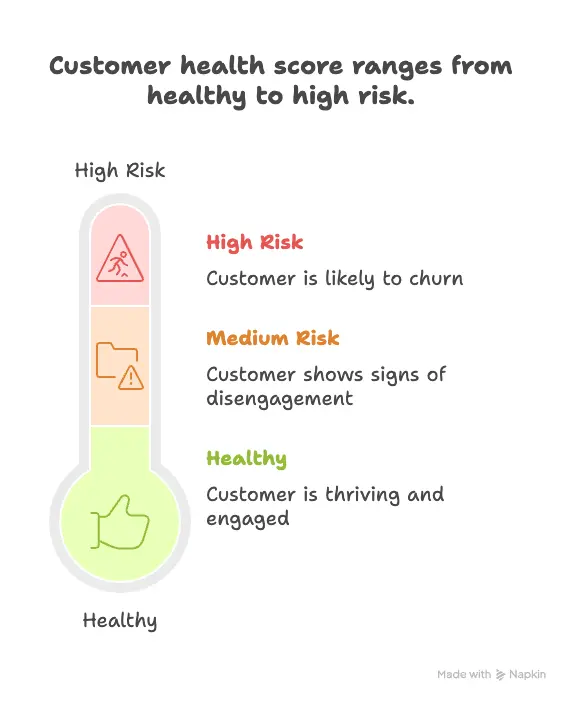

How to build a simple churn prediction model

You do not need complex machine learning to predict churn. Start with a weighted scoring system that combines behavioural indicators, sentiment data, and financial triggers. Assign points to each signal and classify accounts into low, medium, or high risk.

How to reduce churn in SaaS

This is where retention becomes concrete. These strategies work across company sizes and industries.

Improve onboarding and reduce time to value

Fast activation is one of the strongest retention levers. Make it easier for users to complete essential steps. Use contextual in app guidance, checklists, and short walkthroughs. Personalise onboarding for different segments whenever possible.

Increase usage of core features

Every SaaS has a set of behaviours that signal long term retention. Identify your stickiness metrics, measure them weekly, and nudge users toward those behaviours through prompts and reminders.

Build a proactive customer success motion

Do not wait for customers to reach out. Use regular check ins, health score reviews, and proactive help to stay ahead of potential issues. Customer success should own renewal readiness, not only post sales support.

Fix pricing and packaging constraints

Confusing plans and pricing friction cause unnecessary churn. Simplify tier differences, make upgrade paths clear, and offer annual plans to increase retention. Consider a pricing review if you see high downgrade activity.

Reduce involuntary churn

Strengthen your billing logic. Add smart retry schedules, notify customers about upcoming card expirations, and allow pausing subscriptions instead of cancelling. Small fixes often save significant revenue.

Improve support quality

Customers stay longer when support feels reliable and quick. Invest in faster response times, better documentation, and self service resources. Clear answers reduce frustration and help users adopt the product more effectively.

How to analyse and segment churn

Not all churn is equal. Analysing it correctly helps teams focus effort where it matters. Here are my top tips:

Use cohort analysis to understand patterns

Look at retention cohorts by signup month, plan, and usage levels. This reveals where drop offs happen and which segments need intervention.

Segment by behaviour and industry

Customers behave differently based on how they use your product. Track churn across industries, use cases, and activity patterns to identify who stays and who struggles.

Identify high value churn

Large customers with low usage need immediate attention. Not all churn carries the same revenue risk. Focus first on high ARR customers who show early warning signals.

Retention economics: how churn affects growth

Retention is a financial engine. Even a small improvement in churn produces a large impact on long term revenue.

How churn influences LTV

A lower churn rate increases the average lifespan of a customer. This increases LTV, which makes acquisition more efficient and improves payback period.

How churn affects growth trajectory

Companies with high churn must grow acquisition at an unrealistic pace. Lower churn unlocks sustainable growth, stronger margins, and more predictable forecasting.

Why retention compounds

If you improve churn by two percent per month, that impact compounds across the entire customer base over time. Retention improvements rise exponentially, not linearly.

| Monthly Churn Rate | Average Customer Lifespan (Months) | Resulting LTV (Assuming $100 Monthly Revenue) |

|---|---|---|

| 1 percent | ~100 months | $10,000 |

| 2 percent | ~50 months | $5,000 |

| 3 percent | ~33 months | $3,300 |

| 5 percent | ~20 months | $2,000 |

| 8 percent | ~12 months | $1,200 |

| 10 percent | ~10 months | $1,000 |

How to make your organisation retention driven

Reducing churn is not the responsibility of one team. It requires alignment across product, customer success, growth, and revenue.

1. Align product, customer success, and growth

Retention should be a shared goal. Teams must look at the same dashboards and work on the same priorities. A shared understanding of what drives value helps reduce silos and improve execution.

2. Prioritise retention features on the roadmap

Features that strengthen onboarding, increase product adoption, or simplify the customer experience often have higher ROI than new features. Tie roadmap priorities to retention metrics.

3. Create reliable feedback loops

Collect feedback through NPS, churn interviews, and renewal conversations. Feed this into product decisions and improvements. Focus on repeatable patterns instead of isolated complaints.

Advanced strategies to reduce churn

These approaches apply when the basics are already in place and you want to deepen your retention strategy.

1. Predictive modelling for churn risk

Use historical data to score users based on likely churn risk. Even simple models improve how teams prioritise outreach and resources.

2. Personalised engagement based on behaviour

Trigger emails, tips, and in app prompts based on user behaviour. Tailor guidance to push users into healthy adoption patterns and remind them of missed steps.

3. Optimise usage based pricing

Usage based models can reduce churn because customers scale down instead of cancelling. Use pricing data to understand drop offs and optimize thresholds.

Examples and case scenarios

Freemium SaaS with high early churn: The solution often lies in faster time to value, clearer onboarding, and guiding users toward core features sooner.

Enterprise SaaS with renewal churn: Focus shifts toward multi stakeholder value, renewal readiness, account mapping, and regular executive business reviews.

SaaS with onboarding drop offs: Measure activation steps, simplify flows, and refine messaging for clarity. Introduce guided steps for high friction areas.

SaaS with billing related churn: Implement strong retry logic, automated card expiration reminders, and account pausing options.

Checklist for reducing churn in SaaS

- Improve onboarding and activation

- Identify core features and encourage usage

- Build strong customer success habits

- Analyse churn by cohort and behaviour

- Strengthen support quality

- Review pricing and plan clarity

- Improve billing logic

- Create customer feedback loops

- Build retention into product decisions

- Monitor early warning signals

When to bring in a fractional CPO to help reduce churn

Some churn problems point directly to deeper product or organisational issues. When these patterns appear, a fractional CPO can help you fix them quickly and with senior level experience.

A fractional CPO helps with:

- Diagnosing product value gaps

- Improving onboarding and activation

- Aligning product, growth, and customer success

- Reshaping your pricing and packaging

- Redesigning your retention roadmap

- Building a clear strategy that drives predictable growth

If churn impacts your ARR, slows down your revenue predictability, or creates internal uncertainty about product direction, it is the right moment to bring in fractional product leadership.

Get a personalised churn reduction plan. Book a free consultation with a fractional CPO and uncover the product, pricing, and organisational changes that will improve your retention.

Conclusion

Reducing churn is not a single tactic, it is the outcome of a healthy product, a clear value experience, and a team that works together around retention. When you understand why customers leave, spot early warning signals, and build a product that delivers consistent value, churn becomes predictable instead of chaotic. That predictability strengthens your growth engine and creates space for better decisions across product, customer success, and revenue.

Improving churn rarely happens through shortcuts. It comes from clear strategy, thoughtful onboarding, aligned teams, and a product that solves a real problem with clarity. When these pieces work together, the impact compounds. Customers stay longer, expand naturally, and become advocates for your product.

If your churn challenges point to deeper product or organisational gaps, the right support can accelerate progress. A fractional CPO can help you uncover where the real issues sit, reshape your onboarding and value delivery, and build a roadmap that strengthens retention long term.

FAQ’s

What is a good churn rate for SaaS companies?

A good churn rate depends on your business model. SMB focused products often see higher churn because switching is easier. Enterprise products usually have much lower churn due to contracts and higher switching costs. As a general rule, monthly churn under 3 percent or annual churn under 10 percent is considered healthy for most SaaS companies.

What is the difference between customer churn and revenue churn?

Customer churn tracks how many accounts you lose in a period. Revenue churn measures the revenue lost from existing customers, including downgrades. Revenue churn gives a clearer picture of business health since it reflects the true financial impact of churn.

What causes high churn in SaaS?

High churn usually comes from poor onboarding, low time to value, weak product adoption, unclear pricing, inconsistent customer success habits, or billing failures. Most churn begins with early friction in the user journey and becomes visible only when customers cancel.

How can I predict which customers are at risk of churning?

You can predict churn by tracking behavioural signals such as declining usage, reduced engagement with core features, lower seat activity, support complaints, and downgrade attempts. Combining these indicators into a customer health score gives your team a reliable early warning system.

What are the best strategies to reduce churn in SaaS?

Improving onboarding, reinforcing core feature usage, building proactive customer success workflows, simplifying pricing, and reducing involuntary churn are the strongest levers. Clear value delivery combined with consistent engagement keeps customers active and loyal.

Sivan Kadosh is a veteran Chief Product Officer (CPO) and CEO with a distinguished 18-year career in the tech industry. His expertise lies in driving product strategy from vision to execution, having launched multiple industry-disrupting SaaS platforms that have generated hundreds of millions in revenue. Complementing his product leadership, Sivan’s experience as a CEO involved leading companies of up to 300 employees, navigating post-acquisition transitions, and consistently achieving key business goals. He now shares his dual expertise in product and business leadership to help SaaS companies scale effectively.