Stop Hiring Full-Time CPOs at $5M ARR: The Economic Case for Fractional Leadership

December 23, 2025 • 6 min read

Last Updated on February 18, 2026 by Sivan Kadosh

You are about to make a $250,000 mistake.

You’ve hit $5M ARR. Your investors are whispering about professionalizing the C-suite and your engineering team is starting to feel like a feature factory without a blueprint. You think the solution is a heavyweight Chief Product Officer, someone with a shiny resume from a Tier-1 tech giant.

But at $5M ARR, you don’t need a full-time strategist. You need high-level direction and ruthless execution. Hiring a heavyweight CPO too early won’t just bloat your burn rate; it will bore your new hire to death and stall your momentum.

Here is the cold, economic truth about why fractional leadership is the superior play for the $5M to $15M climb.

Key takeaways

- The Cost Gap: A full-time CPO costs ~$400k annually in cash and equity, while a fractional leader provides the same strategic value for less than half that price.

- The Boredom Trap: Experienced CPOs are managers of managers. At $5M ARR, there isn’t enough organizational work to keep them engaged, leading to high turnover.

- Equity Preservation: Hiring fractional allows you to save 1 to 2 percent of your cap table for the scale-up leader you will actually need at $20M ARR.

- The Hybrid Model: The winning play is a Fractional CPO for strategy paired with a Senior PM for daily execution.

The heavyweight trap: Why they quit (or fail) at $5M

Most founders hire for where they want to be in three years instead of where they are today.

When you hire a CPO who managed a team of 50 at a $100M company, you aren’t hiring a builder; you’re hiring a manager of managers. At $5M ARR, your product team is likely two PMs and a handful of engineers.

There isn’t enough high-level strategy to fill 40 hours a week. Within six months, one of two things happens:

1. Strategic overkill

They spend $300k of your capital building complex frameworks and vision decks while the actual product velocity slows to a crawl. They are trying to fly a 747 when you are still operating a Cessna.

Stop guessing. Start calculating.

Access our suite of calculators designed to help SaaS companies make data-driven decisions.

Free tool. No signup required.

2. The boredom exit

They realize they are back to writing JIRA tickets and doing QA. They burn out, realize they miss having a VP of Product reporting to them, and leave. Worse, they take 1.5 percent of your equity with them on the way out.

Case study: The “Jessie” effect & the 40% failure rate

It’s no secret: in high-growth startups, Cash is King. As you scale, you watch dollars leave the account in piles, not trickles. As First Round Review warns in their analysis of hiring mistakes, misallocating this capital on roles you aren’t operationally ready for is a silent killer for early-stage ventures.

Years ago, I advised a 100% bootstrapped startup hitting $5M ARR. They made the classic move: they hired “Jessie” (alias), a top-tier Ex-Google CPO. The package? A $350k base salary and nearly 1% in restricted shares. Jessie was brilliant, but the founders quickly realized the burn rate was unsustainable.

The issue wasn’t just financial; it was structural. Jessie, accustomed to leading large teams at Google, found herself writing basic specs and arguing over JIRA tickets because there was no budget for the mid-level PMs she needed. As SaaStr emphasizes regarding VP hires, placing a strategic leader in a role that requires 100% tactical grind creates a “mismatch of expectations.”

Within eight months, they parted ways. Sadly, this outcome was statistically probable. According to a study published by Harvard Business Review, nearly 40% of new executive hires fail within their first 18 months. The “divorce” cost them over $200k in cash, but the true damage was higher. Topgrading research estimates the cost of a C-level mis-hire can soar to 27x the base salary when factoring in lost momentum and opportunity costs.

Had they utilized the flexible fractional leadership model, they could have leveraged Jessie’s strategy for 20% of the cost while hiring a Senior PM for execution. Instead, they learned the expensive lesson: the right person at the wrong time is the most expensive mistake you can make.

The math: Saving $200,000 immediately

Let’s look at the literal cost of the seat. In 2026, a competent, full-time CPO for a growth-stage SaaS will cost you:

- Base Salary: $250,000 to $325,000

- Bonus and Benefits: $50,000+

- Equity: 1 to 2 percent (The most expensive part of the deal)

- Recruitment Fee: $60,000 (standard 25 percent of base)

Total Year 1 Cash Outlay: ~$400,000.

Compare that to a fractional CPO service. For a high-impact engagement, you might pay a $10,000 to $15,000 monthly retainer.

Total Year 1 Cash Outlay: ~$120,000 to $180,000.

By choosing a fractional model, you instantly keep over $200,000 in the bank. That is the cost of two senior engineers or a massive increase in your ad spend. At $5M ARR, that cash is lifeblood. On a full-time CPO, it is just overhead.

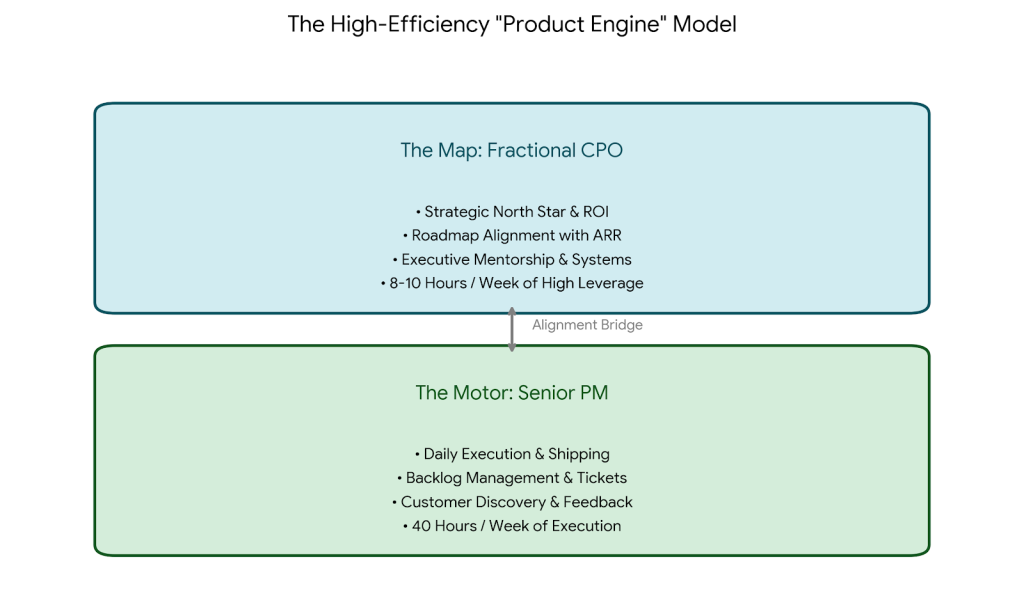

The Product Engine strategy: Strategy plus execution

The mistake competitors make is assuming a Fractional CPO replaces a full-time leader 1 to 1. They don’t. They optimize the engine.

The most successful $5M ARR founders don’t hire one expensive leader. They use the savings from a fractional hire to build a “Product Engine” that actually ships:

- The Fractional CPO: Sets the North Star, coaches the team, and aligns the roadmap with ARR goals. (8 hours a week of high-leverage work).

- The Senior PM: Owns the daily stand-ups, talks to customers, and keeps the devs shipping. (40 hours a week of execution).

This duo costs less than one heavyweight CPO but produces triple the output because the fractional leader focuses only on the high-leverage 20 percent of the work.

Equity preservation: Don’t spend your best chips too early

Equity is your most valuable currency. Giving 1.5 percent to a CPO at $5M ARR is a massive bet. If they aren’t the right fit for the $20M+ stage, you have just diluted yourself for a bridge hire.

A fractional CPO doesn’t take 1.5 percent of your cap table. They are a fee-for-service partner. You save your equity for the Scale-Up CPO you will need at $20M ARR. That is the person who has actually taken a company to an IPO or a massive exit.

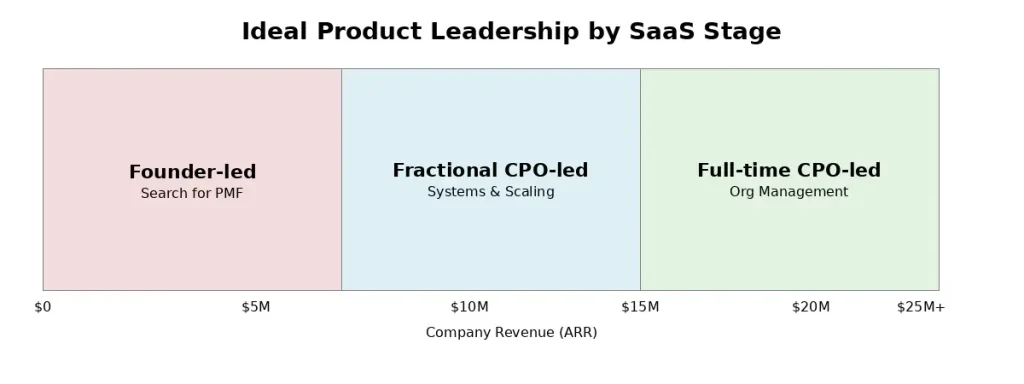

When should you actually hire full-time?

We aren’t saying you never need an FTE CPO. You do. But usually not until you hit these specific milestones:

- Team Size: You have four or more distinct product squads that require daily organizational management.

- Complexity: You are managing multiple products or a complex platform ecosystem.

- Revenue: You are north of $15M to $20M ARR and the CEO can no longer be the primary vision holder.

Until then, an FTE CPO is a luxury that your P&L cannot justify.

Bring order to the chaos without the $400k price tag

Your product is already working. That is how you got to $5M. The problem now is scaling without breaking. You need a system, not a savior.

At SaaS Fractional CPO, we specialize in turning roadmaps into growth engines. We bring the frameworks of a $50M company to your $5M company, without the executive ego or the massive burn rate.

Hire a top fractional CPO and stop the $250k mistake before it starts.

Sivan Kadosh is a veteran Chief Product Officer (CPO) and CEO with a distinguished 18-year career in the tech industry. His expertise lies in driving product strategy from vision to execution, having launched multiple industry-disrupting SaaS platforms that have generated hundreds of millions in revenue. Complementing his product leadership, Sivan’s experience as a CEO involved leading companies of up to 300 employees, navigating post-acquisition transitions, and consistently achieving key business goals. He now shares his dual expertise in product and business leadership to help SaaS companies scale effectively.