Product Portfolio Strategy: How To Build And Manage A High Impact Product Mix

December 5, 2025 • 12 min read

Last Updated on December 5, 2025 by Sivan Kadosh

I have enough gray hair to recall quite a few radical product revolutions over my 20+ years in tech. And it is always, without exception, the same story: products that fail to reinvent themselves and lead the change, or at least ride the wave of it, simply vanish.

I don’t know if you remember the phone giant Nokia. When the cellular era began, they were the “Apple” of the world. Along with BlackBerry and a few others, they dominated the market. But when Steve Jobs took the stage with the first iPhone, they froze. As business analyses later showed, the answer to “who killed Nokia?” is simple: Nokia did. Clinging to past successes and an organizational fear of change prevented them from reacting to the approaching tsunami.

The bad news is that this will happen to your product, too. The good news is that if you know it’s inevitable, now is your time to act. To survive, you must become what Harvard Business Review calls an “Ambidextrous Organization”, a company capable of efficiently managing its current business while aggressively developing its future.

This is exactly where product portfolio strategy comes in. To implement this approach, you need to adopt a mindset similar to McKinsey’s Three Horizons of Growth, dividing your products into three clear buckets:

- Core Products: These are the profit generators that customers pay for today. They are your “cash cows.” Your job is to nurture them, retain them, and ensure they operate flawlessly.

- Growth Products: Your rising stars. They might not generate the steady cash flow of the core yet, but they are growing fast and opening doors to new markets. These are destined to become your core products in two years.

- Innovation (Bets): The experiments and “crazy” ideas. Currently, they look like budget sinks. Most will fail, and that’s okay. But one of them will be your lifeboat when the next technological tsunami hits.

In this guide, we will dive deep into how to build and manage this mix intelligently, ensuring your company remains relevant a decade from now.

Key takeaways

- A product portfolio strategy helps you prioritize what to build, what to maintain, and what to sunset.

- Healthy portfolios balance core products, growth opportunities, and innovation.

- Clear scoring models and KPIs improve decision making across teams.

- Governance and regular reviews prevent resource conflicts and team misalignment.

- A Fractional CPO helps companies create and manage an effective portfolio without the cost of a full time executive.

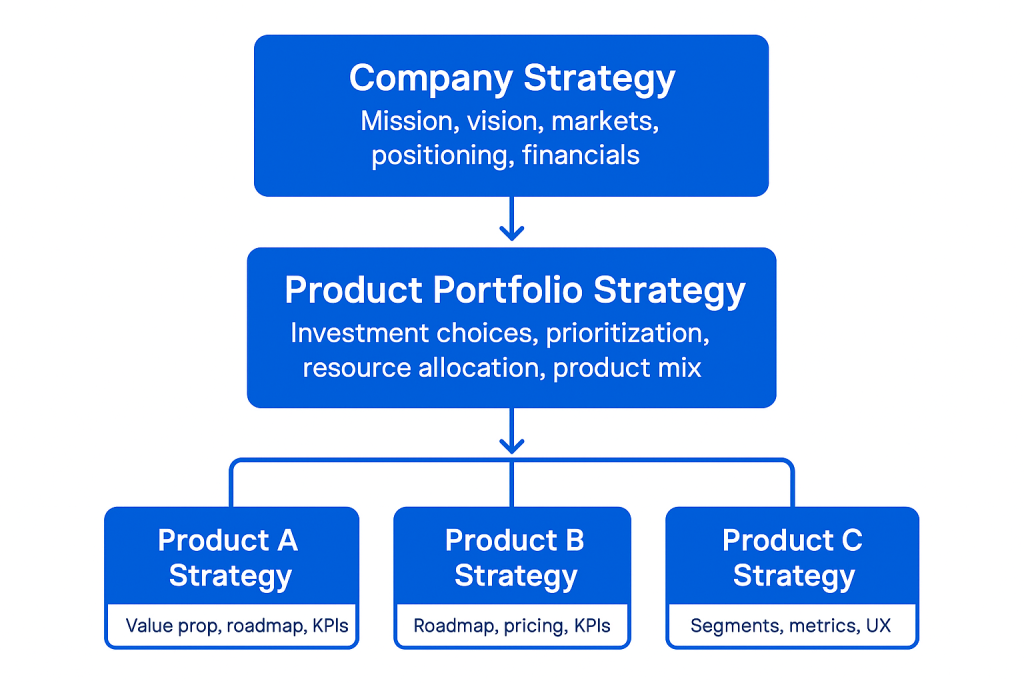

What product portfolio strategy really means

A product portfolio strategy defines how your entire collection of products, product lines, and major initiatives support the company’s goals. It goes beyond individual roadmaps and looks at the overall product mix. A strong portfolio strategy helps you decide which products deserve more investment, which ones require stability, and which may need to be sunset.

Companies that grow quickly often face issues like duplicated features, unclear priorities, and misaligned teams. These problems usually appear when there is no structured portfolio view. Without it, teams work hard but not necessarily in the right direction.

A good portfolio strategy aligns your product investments with market opportunities, customer needs, and business goals. It also ensures that resources are used effectively and that your product mix evolves in a healthy way as the company grows.

Components of a strong product portfolio strategy

A complete portfolio strategy includes several elements that help you make decisions with clarity and confidence:

Stop guessing. Start calculating.

Access our suite of calculators designed to help SaaS companies make data-driven decisions.

Free tool. No signup required.

Portfolio vision

Your portfolio vision sets the direction for the types of problems you solve and the customers you target. It provides guardrails so you do not drift into unrelated markets.

Market and segment coverage

This shows how your products map to customer segments. It highlights gaps, overlap, and opportunities for expansion.

Value creation themes

These are the areas where you want to invest, improve, or innovate. Themes unify teams around common goals.

Revenue and profit goals

Every portfolio needs clear expectations for financial performance. This includes how each product contributes to revenue, margin, and long term growth.

Risk balancing

A balanced portfolio combines dependable products with riskier bets that might unlock bigger opportunities. This balance protects you from over exposure to a single product.

Innovation vs core maintenance

Healthy portfolios allocate resources to keep existing products strong and explore new growth opportunities. Companies often struggle with this balance unless it is clearly planned.

How to evaluate your current portfolio

Start by reviewing all the products and major initiatives in your company. The goal is to understand performance, strategic value, cost, and alignment with your company goals.

Audit your products: Gather data on revenue, profit, customer segments, retention, and operational costs. Include a view of technical debt, maintenance burden, and known risks.

Identify overlaps or gaps: Check if multiple products compete with each other or if new customer needs are not served. Overlap creates internal competition and confusion for users.

Review alignment with strategy: Evaluate how each product supports your company mission and long term plans. Some products may be profitable but not aligned with the future you want to build.

Assess lifecycle stage: Products in early stages deserve different types of investment compared to those in maturity or decline. Understanding lifecycle stages helps you decide where to place your resources.

| Product | Revenue | Cost | Lifecycle stage | Strategic fit | Customer impact | Maintenance effort | Notes or risks |

|---|---|---|---|---|---|---|---|

| Product A | High | Medium | Growth | Strong | High retention | Moderate | Scaling challenges |

| Product B | Medium | High | Maturity | Moderate | Stable usage | High | Significant technical debt |

| Product C | Low | Low | Early stage | Strong | Early traction | Low | Needs more validation of demand |

Portfolio health metrics you should track

Strong portfolio decisions rely on clear metrics. These metrics show whether the portfolio is healthy, imbalanced, or at risk:

- Revenue and profit mix: Healthy portfolios avoid over dependence on a single product. Measure how diversified your revenue and profit streams are.

- Maintenance vs innovation ratio: Track how much of your resources go to stabilizing existing products versus building new ones. Too much maintenance slows growth. Too little maintenance creates technical debt.

- Customer retention by product: Retention helps you see which products are sticky and which need attention.

- Technical debt signals: Monitor issues such as slow releases, frequent bugs, or outdated systems. High technical debt affects the entire portfolio.

- Market opportunity score: Evaluate the potential for each product based on market size, competition, and trends. Products with strong opportunity scores may deserve more investment.

Frameworks to prioritize and balance your portfolio

Clear frameworks help teams make decisions without politics or personal bias.

Portfolio scoring model

Create a scoring model that evaluates products on criteria such as strategic fit, revenue potential, cost, risk, feasibility, and customer value. Add weights to reflect your company priorities. The scores guide how you invest across the portfolio.

Portfolio matrix models

Tools like the BCG or GE matrix help visualize which products are strong performers, which need investment, and which are declining. Adapting these models for product teams makes prioritization easier.

Lifecycle mapping

Mapping products across lifecycle stages helps you understand where to invest, where to maintain stability, and where to reduce investment. This prevents over investment in declining products.

Resource allocation across the portfolio

Resource allocation decisions shape the future of your product mix. Without a clear approach, teams may over invest in low impact areas or neglect key products.

- Invest in core products: These generate stable revenue and support most customers. They deserve ongoing investment so they remain competitive and reliable.

- Support growth opportunities: Products with strong market potential may need more design, engineering, and go to market resources. Scaling these effectively can transform your business.

- Fund innovation: Set aside resources for experimentation, research, and exploring new product ideas. This keeps your company competitive and avoids stagnation.

- Revisit allocation regularly: Business conditions change quickly. Review your allocation quarterly to ensure your investments follow your strategic goals.

Governance and decision making

Governance ensures that portfolio decisions are consistent, transparent, and aligned across teams.

Define ownership

In small companies, the founder or Head of Product usually owns the portfolio strategy. In larger companies, a dedicated portfolio manager or leadership group may take responsibility. The goal is clarity, not hierarchy.

Create transparent criteria

Decisions should follow agreed upon criteria rather than the preferences of individuals or teams. This builds trust and removes friction.

Establish a review cadence

Quarterly reviews help teams stay aligned and respond to market changes. Reviews should include performance updates, strategic alignment checks, and resource adjustments.

Use a Fractional CPO if you lack leadership

Many companies do not have senior product leadership to create and maintain a portfolio strategy. A Fractional CPO brings structure, experience, and clarity without the cost of a full time executive.

When and how to sunset a product

Sunsetting is a step many companies avoid, but it is essential for a healthy portfolio. Retiring a product frees resources, reduces complexity, and eliminates customer confusion.

Criteria for sunsetting

Consider retirement when a product shows declining usage, low profitability, high maintenance costs, or limited strategic value.

Impact assessment

Analyze how sunsetting affects customers, revenue, brand, and operations. This helps you prepare a transition plan that minimizes disruption.

Customer migration plan

Guide customers to alternative products or solutions. Provide support, clear communication, and timelines so they understand the next steps.

Internal communication

Teams need to understand why a product is being retired and how responsibilities will shift. This reduces uncertainty and resistance.

Measure success

Track how well the transition went and whether the expected resource savings or strategic benefits were achieved.

The “Zombie Product” trap: Overcoming the sunk cost fallacy

Real-world experience shows that the hardest part of sunsetting isn’t technical, it’s psychological. Often, teams fall into the “Sunk Cost Fallacy,” refusing to retire a declining product simply because they have already invested years into it. A common scenario discussed by product leaders involves the “Zombie Product”: a legacy feature used by only 5% of high-paying customers that consumes 30% of engineering resources, effectively holding the entire roadmap hostage. To break this cycle, you must shift the conversation from “what we lose by killing it” to “the opportunity cost of keeping it alive.” Data proves that reallocation is key; companies that actively reallocate resources from failing initiatives to growth areas achieve significantly higher returns.

Portfolio strategy for different company stages

Portfolio strategy depends on the maturity of the company. The needs of a startup are very different from those of an enterprise.

Startups

Startups should focus on the core product and avoid spreading their resources across too many ideas. One strong product beats three weak ones.

Scale ups

Scale ups often expand quickly. They need clear prioritization models and governance to avoid duplication and wasted effort. This is usually the stage when a portfolio strategy becomes essential.

Mature companies

Enterprises must manage large portfolios, legacy systems, and complex dependencies. They benefit from strong review processes, sunsetting, and clear investment themes.

Tools and templates you can use

Provide readers with practical tools they can implement immediately.

Portfolio dashboard template: Helps track KPIs such as revenue mix, margin, debt signals, and retention.

Scoring matrix: Guides prioritization based on criteria like feasibility, strategic value, revenue potential, and risk.

Lifecycle planning sheet: Shows where each product sits in its lifecycle.

Sunset checklist: Helps ensure no step is missed during product retirement.

Get expert support with your product portfolio strategy

Building a product portfolio strategy requires structured thinking, strong decision frameworks, and experience with both growth and complexity. Many companies struggle with this because they lack the senior leadership needed to guide product decisions at a high level.

If you want support in building or optimizing your portfolio, consider working with a Fractional CPO. You get strategic leadership, decision clarity, and a roadmap that prioritizes the highest impact opportunities, without the commitment of a full time hire.

A Fractional CPO can help you run portfolio reviews, build scorecards, decide where to invest, and create a long term strategy that aligns your entire product organization.

Conclusion

A product portfolio strategy helps you make better decisions, reduce waste, and invest in the right opportunities. It gives you a structured view of your entire product mix so you can scale with confidence. By using scoring models, clear metrics, regular governance, and a willingness to sunset products that no longer fit, you create a portfolio that supports long term growth. Start with a simple audit, build your first scoring model, and schedule a quarterly review. The clarity that comes from portfolio thinking will change how your team builds and plans for the future.

FAQ’s

What is a product portfolio strategy and why does it matter?

A product portfolio strategy defines how all your products and major initiatives work together to support company goals. It matters because it prevents teams from spreading themselves too thin, investing in low value areas, or duplicating efforts. A strong portfolio strategy helps you prioritize investments, align teams, and grow in a focused and sustainable way.

How is product portfolio strategy different from product strategy?

Product strategy focuses on a single product. It covers direction, value, target users, and features for that specific product. A product portfolio strategy looks at the entire product mix and decides how much to invest in each product, how they fit together, and which ones support the long term direction of the company. Portfolio strategy guides resource allocation and ensures the whole system grows in a healthy way.

How do I know if my company needs a product portfolio strategy?

You likely need one if you have more than one product, if teams argue over resources, if some products feel neglected, or if your roadmap feels chaotic. Other signs include overlapping features, poor coordination across teams, or unclear investment priorities. A portfolio strategy brings order and clarity to these situations.

What metrics should I track to evaluate portfolio health?

Useful metrics include revenue mix, profitability per product, customer retention, market opportunity score, technical debt levels, and the ratio between maintenance work and innovation. These metrics help you see whether the portfolio is balanced, over reliant on a single product, or carrying hidden risks.

How often should we review our product portfolio?

Quarterly reviews work well for most companies. This cadence allows you to evaluate performance, adjust resource allocation, and respond to market changes without constant disruption. Larger companies with slower cycles may review every six months, while fast moving startups may revisit their portfolio more frequently.

What role does a Fractional CPO play in product portfolio strategy?

A Fractional CPO brings senior level expertise to help companies build clarity, evaluate tradeoffs, and create a balanced portfolio without hiring a full time executive. They guide prioritization, scoring, governance, and long term planning. This is especially valuable for companies that are growing quickly or managing multiple products without dedicated product leadership.

How do you decide when to sunset a product?

Evaluate usage trends, profitability, maintenance cost, strategic alignment, technical debt, and market relevance. If a product consumes resources but no longer contributes meaningfully to the business, it may be a candidate for sunsetting. A structured migration plan and clear communication ensure that customers transition smoothly.

What frameworks help with portfolio prioritization?

Useful frameworks include scoring models based on strategic fit, market potential, revenue impact, feasibility, and risk. You can also use portfolio matrices such as the BCG or GE models to visualize product positioning. Lifecycle mapping adds an extra layer by showing which products need investment and which are nearing retirement.

How should startups approach portfolio strategy?

Startups should keep their portfolio simple. Focus on one strong product and avoid splitting attention across too many ideas. As the company grows and finds traction, you can expand the portfolio with more structure and clearer prioritization models.

Sivan Kadosh is a veteran Chief Product Officer (CPO) and CEO with a distinguished 18-year career in the tech industry. His expertise lies in driving product strategy from vision to execution, having launched multiple industry-disrupting SaaS platforms that have generated hundreds of millions in revenue. Complementing his product leadership, Sivan’s experience as a CEO involved leading companies of up to 300 employees, navigating post-acquisition transitions, and consistently achieving key business goals. He now shares his dual expertise in product and business leadership to help SaaS companies scale effectively.