The Series B Trap: Why VCs Are Passing (Even If You Hit Your Revenue Targets)

December 30, 2025 • 7 min read

Last Updated on February 18, 2026 by Sivan Kadosh

You hit your revenue targets. You grew 2.5x year-over-year. You have a polished pitch deck and a pipeline full of logos. Yet, for the third time this month, a Series B partner has told you, “We love the vision, but we’re going to pass right now.”

Welcome to the Series B Trap.

In the zero-interest rate era (ZIRP), growth was the only metric that mattered. If you could show top-line velocity, investors would throw money at the fire. In 2025, the game has changed entirely. The Series A round is about product-market fit. The Series B round is about business-model fit.

Investors aren’t looking at your top line anymore; they are looking at your Product Engine, and right now, yours is sputtering. They see high churn, low expansion, and a roadmap that is reactive rather than strategic.

Here is why your “growth at all costs” strategy is making you unfundable and how to fix it before your runway runs out.

Key takeaways

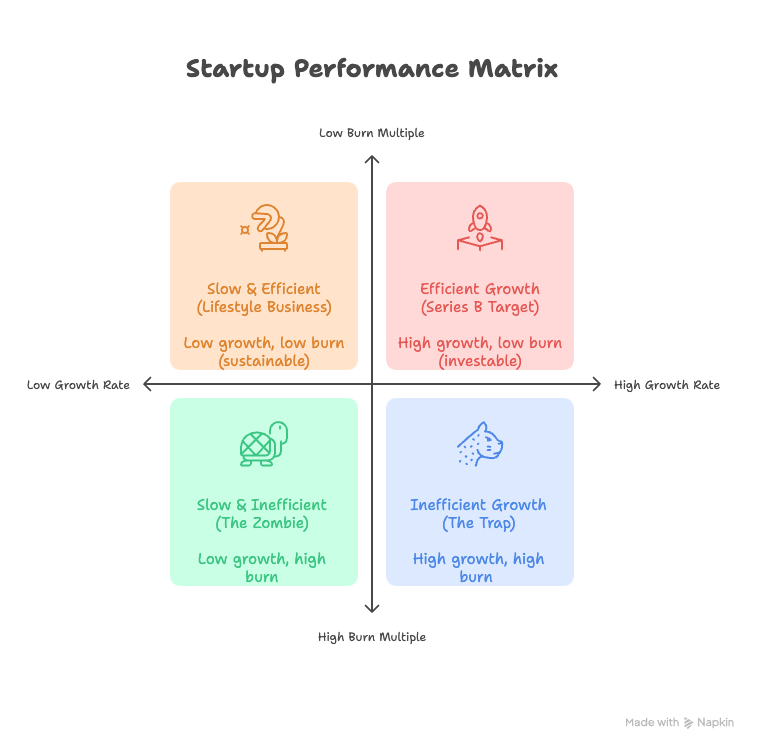

- The Metric Shift: Series B investors have moved from valuing raw ARR growth to valuing “Efficient Growth” (NDR, CAC Payback, Gross Margin).

- The Debt Collector: Technical and product debt accumulated during the “Series A scramble” usually comes due at $10M ARR, slowing velocity to a crawl.

- The “Feature Factory” Problem: Shipping more features doesn’t equal more value. You need to prove your product team generates outcome-based ROI, not just code.

- The Solution: Transitioning from “Founder Instinct” to a scalable “Product Operating System” is the only way to survive due diligence.

| Metric / Focus | Series A (Growth Focus) | Series B (Efficiency Focus) |

| Primary Goal | Product-Market Fit | Business Model Fit |

| Growth Expectations | >100% YoY (Top Line matters most) | >80% YoY (Efficiency matters most) |

| North Star Metric | New Signups / Logos | Net Dollar Retention (NDR) > 110% |

| Financial Health | Monthly Burn Rate (Runway) | Rule of 40 (Growth + Profit margin) |

| Unit Economics | LTV:CAC (Often loosely defined) | CAC Payback Period (< 12 Months) |

| Churn Tolerance | High (15-20% is often ignored) | Low (Must be <10% Gross Churn) |

| Product Strategy | Feature Velocity & Acquisition | Expansion & Retention Loops |

Insider view: The “Leaky Bucket” reality check

I recently spoke with “Jim” (name changed), a scout for a prominent European VC who reviews hundreds of potential deals a year. We were discussing a startup that seemed perfect on paper because they showed aggressive growth and had just hit their revenue milestones. But Jim passed without hesitation.

When I asked him why, his answer was blunt: “They are renting their revenue, not owning it.”

Jim explained that while the topline looked impressive, their unit economics revealed a “Leaky Bucket.” They were buying growth through unsustainable CPA, but customers were churning almost as fast as they were acquired. This strategy is fatal in the current market.

According to ProfitWell, customer CAC have increased by over 60% in the last five years, making it impossible to outrun churn with paid ads. Investors know this. Data from SaaS Capital indicates that top-quartile SaaS companies maintain a NDR of 110% or higher, and these are the companies commanding premium valuations. Jim is looking for that efficiency because, as research from Bain & Company famously demonstrated, a mere 5% increase in customer retention can increase profits by 25% to 95%. If you are asking a VC to fund a Leaky Bucket, do not be surprised when they turn off the tap.

Stop guessing. Start calculating.

Access our suite of calculators designed to help SaaS companies make data-driven decisions.

Free tool. No signup required.

The “hollow revenue” problem

Why would an investor pass on a company growing 100% YoY? Because not all revenue is created equal.

At $2M ARR (Series A), you can muscle your way to growth. The founder can close deals, the CS team can heroically save churning accounts, and you can buy growth with heavy ad spend.

At $10M ARR (Series B), you cannot muscle it anymore. The law of large numbers kicks in. If you have 15% annual churn, you have to replace $1.5M in ARR just to stay flat.

Investors are looking for “Hollow Revenue”: revenue that is high-maintenance, low-margin, or prone to churn. If your growth is coming from aggressive sales but your product retention is leaking, you are a risky bet.

The symptoms of a Series B trap

- Slowing Velocity: It takes 3x longer to ship a feature today than it did a year ago.

- The “HiPPO” Roadmap: The Highest Paid Person’s Opinion (usually the CEO or VP Sales) dictates what gets built, rather than data.

- Customer Success Burnout: Your CS team is acting as “human duct tape” for product gaps.

The 4 metrics that actually matter now

To escape the trap, you need to stop obsessing over net new logos and start obsessing over the mechanics of your machine.

1. Net Dollar Retention (NDR)

This is the holy grail of Series B. Investors want to see that your existing customers are spending more money with you every year (ideally 110%+).

- The trap: You focus on acquisition (Sales) and ignore expansion (Product).

- The fix: Your product team must own “Expansion Revenue” as a core KPI. Features should be built specifically to drive upsells, not just to close new deals.

2. CAC Payback Period

How long does it take to earn back the money you spent to acquire a customer? In a healthy Series B company, this should be <12 months.

- The trap: You have bloated Sales/Marketing spend because the product isn’t “Product-Led” enough to help close deals.

- The fix: Use Product-Led Growth (PLG) mechanics to lower acquisition costs (e.g., self-serve onboarding, free trials that actually convert).

3. R&D Efficiency (The “Burn Multiple”)

Investors look at how much ARR you generate for every dollar of R&D spend.

- The trap: You hired 20 engineers, but output didn’t increase. You just added communication overhead.

- The fix: A fractional CPO implements “Squad Autonomy”, breaking the monolith into small, outcome-focused teams that can ship independently.

Why “Founder Instinct” fails at $10M ARR

The biggest bottleneck at Series B is often the CEO.

From $0 to $5M, your intuition was the company’s greatest asset. You knew the customers, you knew the market, and you made the calls. But at $10M+, your intuition becomes a liability. You are too far removed from the individual user to make micro-decisions on the roadmap.

When a CEO tries to act as the CPO at this stage, two things happen:

- Bottlenecks: The team waits for your approval on button colors, stalling velocity.

- Bias: You prioritize features based on the one angry customer who emailed you this morning, ignoring the data from the other 5,000 users.

You need a system, not a savior. You need to transition from “Founder-Led” to “Product-Led.”

Information Gain: The “Product Operating System”

Most advice tells you to “hire a VP of Product.” But hiring a headcount doesn’t solve a process problem. You need a Product Operating System.

This is the infrastructure that turns capital into code, and code into cash.

1. The Strategy Layer

Does everyone in the org know why we are building this quarter’s features? If you ask a junior engineer and a sales rep, will they give the same answer? If not, you have a strategy gap.

2. The Discovery Layer

Are you building what customers say they want, or what they actually need? A Series B product engine creates a continuous loop of customer interviews, data analysis, and prototyping. You stop betting $50k on a feature based on a hunch; you bet $5k on a prototype to validate it first.

3. The Delivery Layer

This is about “Shipping to Learn,” not just shipping to release. Every feature must have a success metric attached to it before code is written. If it doesn’t hit the metric, you kill it or fix it. You don’t just move on to the next ticket.

How to fix your metrics in 2 quarters

If you are currently stuck in the trap, you don’t have time for a 12-month transformation. You need to show progress by the next board meeting.

Month 1: The “Debt” Audit Stop new feature development for two sprints. Fix the critical tech debt that is causing churn. Improve the load times. Fix the bugs that support tickets are screaming about. This stops the bleeding.

Month 2: Pricing & Packaging Often, your NDR problem is actually a pricing problem. You are giving away too much value in the base tier. A fractional CPO can restructure your tiers to create natural upsell paths (e.g., charging by usage, seats, or advanced features).

Month 3: The “Expansion” Sprint dedicate one squad entirely to “Expansion.” Their only job is to build features that existing customers will pay more for.

Escaping the trap

Raising a Series B isn’t about promising a brighter future; it’s about proving a scalable present.

Investors need to see that if they pour $20M into your machine, the machine won’t break. They need to see a Product Engine that is predictable, efficient, and independent of the founder’s daily intervention.

At SaaS Fractional CPO, we specialize in this specific transition. We help founders install the “Series B Operating System” without the cost or risk of a bad executive hire. We fix the engine so you can fuel the growth.

Don’t let inefficiency kill your valuation.

Additional resource: What a SaaS Fractional CPO Does for Series A and B Startups

Sivan Kadosh is a veteran Chief Product Officer (CPO) and CEO with a distinguished 18-year career in the tech industry. His expertise lies in driving product strategy from vision to execution, having launched multiple industry-disrupting SaaS platforms that have generated hundreds of millions in revenue. Complementing his product leadership, Sivan’s experience as a CEO involved leading companies of up to 300 employees, navigating post-acquisition transitions, and consistently achieving key business goals. He now shares his dual expertise in product and business leadership to help SaaS companies scale effectively.